97 Large Cap Growth Stocks that Beat the Market

With the markets up so much, I was wondering if growth stocks are finally back after receiving much of the brunt from the rising rates and horrible macro economy.

There are several ways to find out how growth stocks are doing. You could rely on benchmarks like the NASDAQ100. But while doing that, I found Morningstar’s list of Large-Cap Growth stocks. They derived this list using several criteria.

The stocks have to be:

✅Among the 70% biggest U.S. equities by market cap

✅Exhibit growth characteristics by having high growth rates on sales, earnings, book value and cash flow

✅Have strong valuation with high price ratios and low dividend yields.

There were 462 stocks that actually made the list.

👋 Welcome to tbh.finance. Here, we write about stocks, ETFs and finance honestly. If you enjoy today’s article, do subscribe to receive more like this in your inbox.

After removing OTC stocks and duplicates, I looked at their performances and found:

only 97 managed to beat the S&P 500’s ~20% YTD returns

only 40 beat the NASDAQ 100’s ~43% returns.

I won’t cover all of them here, but let’s take a look at the Top 5!

#5 Nu Holdings (NYSE: NU) +120.2%

Nu Holdings is a digital banking platform in Brazil, and it is one of the fastest growing fintech stocks currently.

It has managed to grow its Average Revenue per Active Customer (ARPAC) steadily over the past few quarters, which shows its ability to monetize customers efficiently.

At the same time, revenue has been growing steadily over the past 10 quarters.

Nu Holdings continues to gain market share in Brazil and is currently the 4th biggest financial institute in the country. It also serves customers in Mexico and Colombia.

Fun fact: Nu Holdings makes up about 0.16% of Berkshire Hathaway's portfolio.

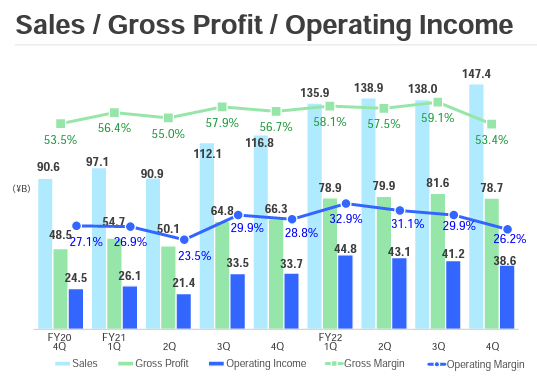

#4 Renesas Electronics Corp (TYO: 6723) +134.9%

Renesas Electronics is a manufacturer of semiconductor products. They serve clients in the automotive, industrial, infrastructure and IoT industries. It had announced the re-opening of its "Kofu" Fab by 2024 which will allow the company to double its power semiconductor production capacity.

Although it reported a dip in its total revenue in 1Q23 (blue bar in image below), its Net Income has been rising over the past 7 quarters, except for a slight dip in 4Q22.

While its share price performance has definitely benefited from the general bullishness of the tech industry, Renesas has an aggressive plan to grow its market cap to US$20B by 2023 via a mix of M&A and expansion of services.

#3 Tesla Inc (NASDAQ: TSLA) +145.4%

Tesla needs no introduction.

This giant EV manufacturer had reported record deliveries in 2Q23, but failed to impress investors with its declining margins during their latest earnings call.

Tesla is currently facing some headwinds due to heavy competition in its key markets (China and US).

However, it still has a backlog of car orders to fulfill which serves as a buffer while the company attempts to increase sales via referral programs and maximizing EV incentives in its key markets.

While Tesla is a key player in the EV industry currently, it would likely undergo a few more cycles of ups and downs as companies fight it out in this competitive industry.

Whether or not the company will become the leader in EV still remains to be seen.

#2 Advantest Corp (TYO: 6857) +146.7%

Advantest is a leader in the manufacturing of automated semiconductor test equipment. It was involved in the establishment of the Semiconductor Test Consortium in 2002, and had recently launched an AI-powered software solution to improve test yields.

As a company involved in semiconductor testing, Advantest's performance is highly reliant on the overall semiconductor markets. This was evident in the later half of 2022 when earnings and revenue stalled due to the market slowdown.

Advantest is likely to benefit from the current semiconductor demands in the short term,

keep an eye on the semiconductor industry if you wish to avoid holding onto Advantest during down cycles.

#1 NVIDIA NASDAQ: NVDA +219.1%

Nvidia manufactures graphic processing units (GPUs). Its GPUs are currently the best in class and are heavily relied on in AI development.

As Nvidia steals headlines for its growth and its supply crunch, new players are attracted into the GPU manufacturing scene. Nvidia will eventually have to balance the challenges of keeping up supply while holding competition off.

Nvidia is one of the biggest winners in the latest AI hype, so it is no surprise that the stock is overbought at the moment. If you're bullish about NVDA's ability to remain as one of the leaders in GPUs, wait for a correction before getting in!

👋Thanks for reading! tbh.finance writes about stocks, ETFs and finance honestly. If you enjoy today’s article, do share it with your friends.

If you hated it, hit reply and let us know!