👋Welcome to tbh.finance. Here, we write about stocks, ETFs and finance honestly. If you enjoy today’s article, do subscribe to receive more like this in your inbox.

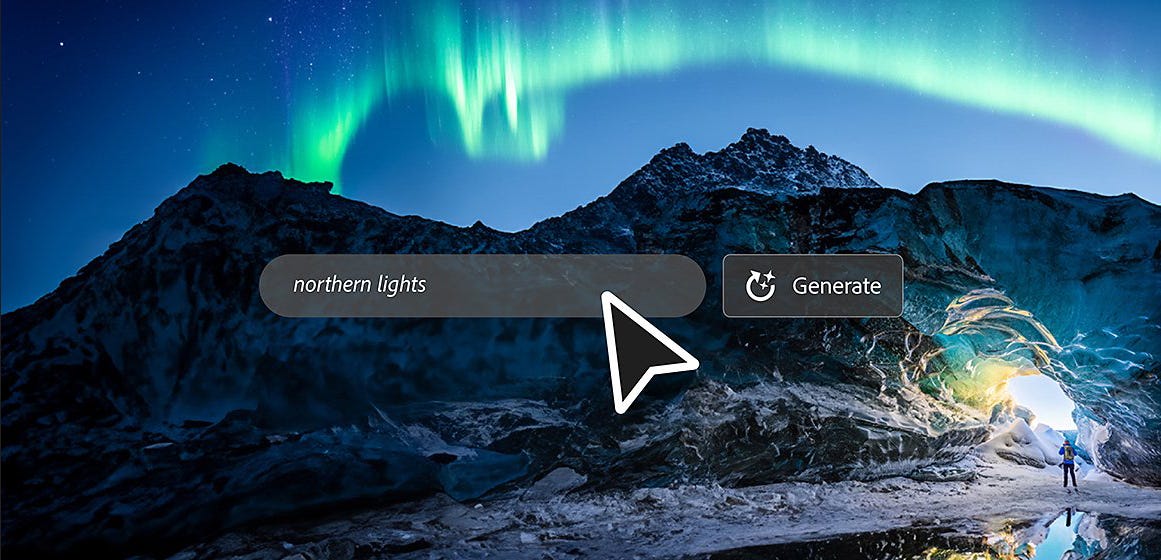

🖼️Generative AI in image creation is nothing new, you've probably seen images made with MidJourney, Dall-E and the likes.

While these generative AI software were gaining popularity, Adobe, one of the major players in the creative software space had been silent.

Eerily silent.

But now:

Adobe has officially entered the AI race 🏃♂️

In March 2023, they announced Firefly to little fanfare. It seem as though the creative giant was just playing catch up.

Then on 23rd May, they announce the new "generative fill" function which took the internet by storm.

Twitter and Reddit were taken over by memes:

Astute punters investors pumped Adobe’s price by ~17%.

Let’s dive into Adobe’s business👇

💪Adobe reported record revenue of $4.66 billion in 1Q23

which was a 9% y-o-y growth in revenue!

They also reported good growth in both of their key segments:

1. Digital Media

This segment includes the Adobe Creative Cloud (i.e. Photoshop, Illustrator, Premiere Pro, and many more) as well as Adobe Acrobat.

Creative Cloud which grew by 8% y-o-y remains the go-to solution for many creative professionals, while Adobe Acrobat (aka Document Cloud) grew by 13% y-o-y continues to change how people share and sign documents across platforms.

2. Digital Experience

This segment includes Adobe’s business products that help businesses improve their marketing workflows.

Their upcoming earnings is due soon on 15 Jun 2023, and would be worth watching.

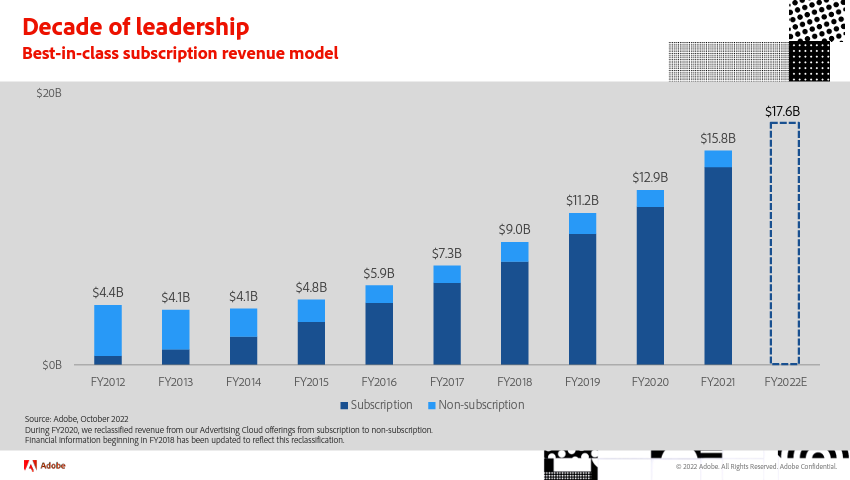

📈Adobe has been growing subscription steadily

Since shifting to a subscription based model, Adobe has been growing its subscription revenue consistently.

Adobe’s Creative Cloud is also quite a sticky product due to the value it offers. Hence, retention rates should high (estimates suggest retention rates of about 90%).

Adobe’s management is optimistic that it will continue to grow. 📈

They had increased their FY23 net new AAR & EPS targets during the 1Q23 earnings call:

Is ADBE a buy? 💰🤔

Looking at the common valuation metrics, Adobe still looks relatively cheap:

Price-to-Sales (PS)

PS tells you how much you're paying for a stock, relative to the revenue the company generates.

Currently, Adobe’s PS is about 11, which is lower than its average 5 year PS ratio of 14.7. This suggest that Adobe may still be undervalued.

Next, let’s also look at;

Price-to-Earnings (PE)

PE tells you how much you're paying, relative to a stock’s earnings per share.

Currently, Adobe’s PE is about 42 while its past 5 year average PE was around 48. This also suggests a slight undervaluation.

🛑✋

But given that Adobe’s share price had run recently, let’s take a look at Adobe’s RSI (we explained more about the RSI here).

Relative Strength Index

As you can see the RSI suggests that Adobe has currently hit overbought territory.

🥊Adobe’s main challenge

The generative AI space is highly competitive. 👊

We will see new players emerging as startups attempt to enter this new sector while incumbents release new products to cater to the evolving needs of users.

🖼️Will you consider Adobe in your portfolio?

While Adobe has deliver strong performance in 1Q23 and continues to have a strong balance sheet, its management will be kept on their toes as they fence off new players while innovating in the AI arena.

That said, the successful launch of its Generative Fill feature has given us a glimpse to its generative AI capabilities.

Although there will be challenges along the way, Adobe will likely continue grow its subscription revenue across both its segments.

However, given that Adobe’s RSI is currently in overbought regions, you may want to wait for a better entry point.

Regardless, I’ll be keeping tabs on their upcoming earnings call that’s due on the 15 Jun.

What do you think about Adobe’s business?