Who doesn't love dividends and the feeling of receiving money passively?

But no one has the time to sift through a bunch of individual stocks? That's where dividend ETFs come in! They do all the work for you, so you can invest, sit back and watch that money roll in.

Right?

Well, not really.

I did some number crunching and let me tell you, most dividend stocks are just not worthwhile.

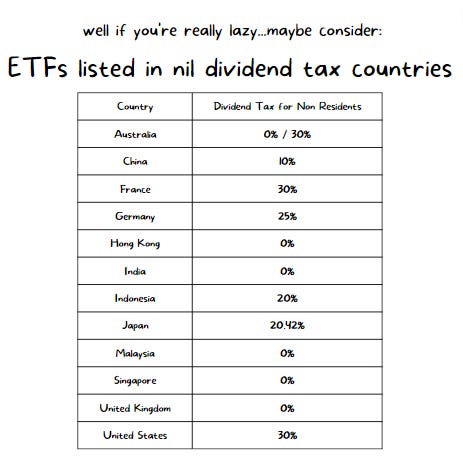

For starters, dividend gains can be taxable, and depending on where the ETF is located, that tax could eat into your earnings like a ravenous monster.

But taxes are not the only culprit behind dividend ETF’s poor performance, there’re fees (aka expense ratio) too.

Plus, some of these ETFs are so focused on high yields, they forget to actually make you any money in the long run.

So, what's an aspiring dividend investor to do?

Do we still stand a chance with dividend ETFs?

To find out, I looked into some popular options. But, it doesn’t bode well.

The Global X SuperDividend ETF sounds like a dream with its 10.18% dividend yield paid out monthly, but after that pesky 30% dividend tax, you're left with only around 7%. And let's not forget that the ETF's overall performance has been so lackluster, you might not even make that much in the end.

A common option to reduce that tax hit is to look at Irish-domiciled ETFs, but unfortunately, there aren't many dividend-focused ones to choose from.

Another option is to look at ETFs listed in countries with no dividend tax, like Singapore.

Unfortunately, even the highest yielding Singaporean ETFs didn't make my minimum cut of 5%. 😔

After all the work I’ve done so far, I refused to give up.

I mean, there's always the UK right?

The iShares UK Dividend UCITS ETF yields a decent 5.34%, but after accounting for expenses and currency fluctuations, the gains were not as impressive as they first appear.

And for those feeling adventurous, there's Hong Kong too.

The Global X Hang Seng High Dividend Yield ETF yields a tempting 7.04%, but after taking into account dividend taxes and ETF fees, you're only looking at around 5.66% in real dividend gains. Plus, over a third of those "gains" are actually just capital distributions, which lower the share price and don't count as actual earnings.

At the end of the day, if you’re in it for passive income, building your own dividend stock portfolio might just be the best way.