Does SCHD deserve a spot in your ETF portfolio?

for the folks looking to build a balanced, long-term ETF portfolio that you can DCA into regularly...

👋Welcome to tbh.finance. Here, we write about stocks, ETFs and finance honestly. If you enjoy today’s article, do subscribe to receive more like this in your inbox.

If you’re looking to build a fuss-free ETF portfolio that consistently outperforms the S&P500, you might be thinking of adding a dividend ETF into the mix.

The Schwab U.S. Dividend Equity ETF aka SCHD is a popular dividend ETF that offers consistent dividend payout.

But does it deserves a spot in your ETF portfolio?

🤔👇

What is SCHD ETF? 💰

The Schwab U.S. Dividend Equity (SCHD) ETF is a low-cost 💰 dividend focused exchange-traded fund.

It tracks the Dow Jones U.S. Dividend 100 Index, giving you exposure to high-quality U.S. stocks that have been paying consistent dividends for at least 10 years. (that’s way longer than my longest employment contract!)

This means, instead of having to sit, read and research on hours for high quality stocks based on their cash flow to total debt, return on equity, dividend yield and 5-year dividend growth rate, you can own a portfolio of strong U.S. dividend stocks in a single trade.

Key characteristics of SCHD:

Expense ratio: 0.06%

Dividend Yield (TTM): 3.84%

No. of holdings: 104

Assets Under Management: US$44.93B

Inception Date: 20 Oct 2011

✅ How did SCHD perform historically?

At the point of writing, SCDH had delivered:

🎯 Did SCHD beat S&P 500?

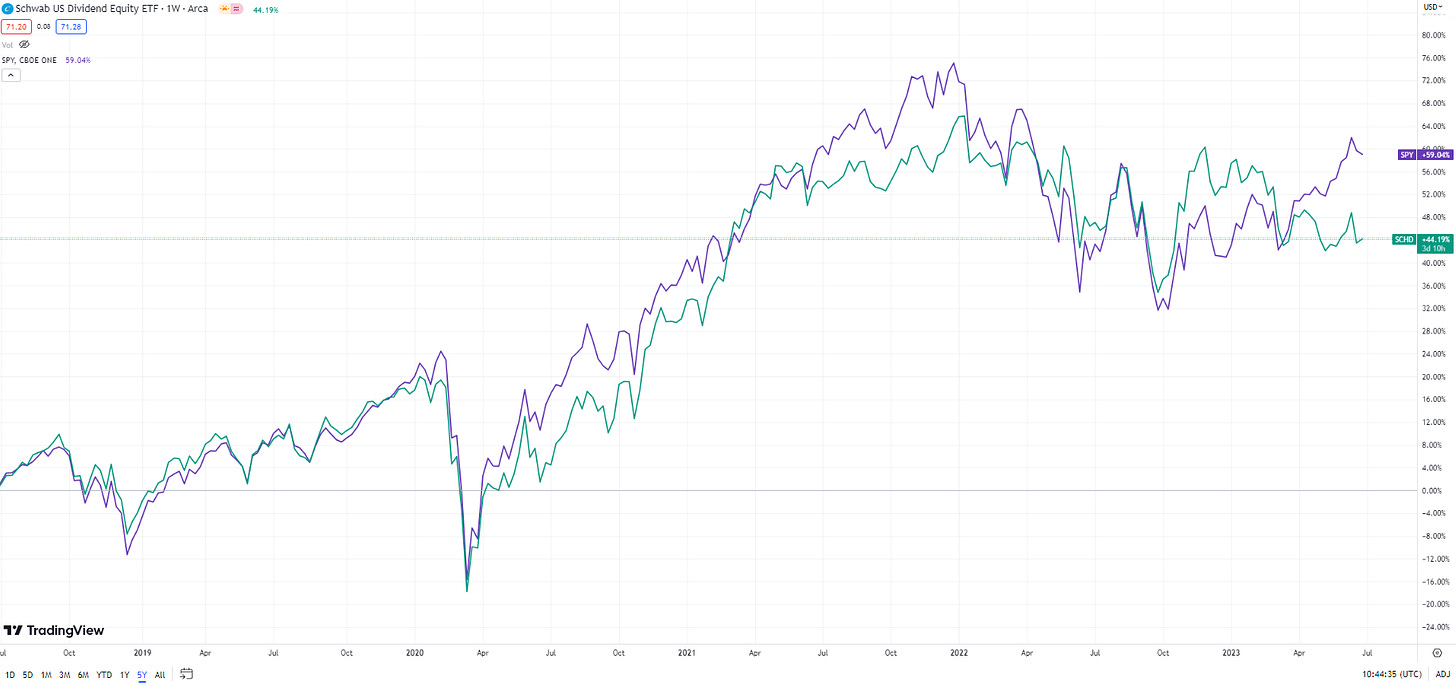

If we are looking purely at the price performance of SCHD, no, it didn’t outperform the S&P 500.

This was how SCHD performed against the S&P 500 in the past 5 years:

But SCHD’s individual performance isn’t the focus here.

Instead, you’re probably wondering: what if you had invested in a 50% VTI, 50% SCHD portfolio, would you have outperformed the S&P500?

Here’s a comparison of 2 popular ‘passive’ ETF portfolios against the S&P 500 over the past 5 years. (assuming DCA of $10,000 on an annual basis.)

Unfortunately, due to the outperformance of a few key sectors (namely the US big tech and growth stocks) in the recent months, the equal weight VTI/SCHD portfolio has underperformed the S&P 500.

You would done much better with an equal weight VTI/SCHD/QQQ portfolio. (again this is due to the short term bullishness in tech and growth stocks)

What stocks would you own with SCHD?

So, what types of stocks would you find in the SCHD ETF portfolio? Here’re the top 10 holdings at the point of writing:

SCHD 🆚 JEPI

JPMorgan Equity Premium Income (JEPI) ETF is another popular dividend ETF among investors. It has performed relatively well in recent months, and investors are wondering if they should substitute their SCHD with JEPI instead.

Let’s take a look at the historical performance of these 2 ETFs:

As you can see, although JEPI did outperform SCHD in recent months, SCHD had outperformed consistently.

Of course we cannot assume that historical performance would indicate future returns, however, you should note that the investment style of JEPI differs from that of SCHD.

JEPI is an actively managed ETF that relies on trading call options for a regular monthly income. Hence, expect higher fees (at 0.35% vs SCHD’s 0.06%) and higher risk over the long term.

💁♂️Does SCHD deserve a spot in your ETF portfolio?

If your aim is to invest consistently in a balanced ETF portfolio that is easy to manage, you may want to include SCHD alongside a US market ETF like the VTI and/or a high growth ETF like QQQ or its cheaper alternative, QQQM.

For more ETF portfolio ideas, grab our guide here or read this compilation of the Best ETFs to buy and hold.