👋Welcome to tbh.finance. Here, we write about stocks, ETFs and finance honestly. If you enjoy today’s article, do subscribe to receive more like this in your inbox.

In the medieval times, slaves were made to dig out moats around a castle or fortress as a defensive mechanism to keep enemies at bay.

Today, the concept of ‘moat’ is frequently used in investing as an analogy of a business’ competitive advantage.

It was made popular by Warren Buffett who likens competitive advantage to a castle’s moat:

For example, Alphabet’s dominance in search is a strong moat that has protected the company from competitors over the past 15 years.

But if you have watched Money Heist, you’ll also know that there is no impenetrable defense. In recent months, we’re watching a heist on Alphabet’s moat unfold as Bing (and Baidu) release their AI powered search features.

Whether or not Alphabet’s castle will remain standing is a discussion for another day.

For now, let’s talk about Warren Buffett.

Warren Buffett is the most successful investor in the 20th century. He has survived numerous bear markets and as of March 2023, his net worth hit over $104B!

His average annual return is about 19.8% since 1965. The S&P 500 only returned about 9.9% annually in the same period.

If those numbers don’t mean much to you, trust me - Buffett’s the real deal.

It is difficult for us mere mortals to build a portfolio that generates similar returns, over such a long investment period.

And finding businesses with moats is not that easy:

You’ll need to study every business in detail, understand how the industry works and figure out if a business has a true moat.

And most of the time, you’ll draw a blank.

Honestly, no one’s got time to study every business in detail before putting their money in. If we tried, we’d be spending everyday pouring over industry reports, financial reports, keeping up with news and finally be fired by our bosses.

Thankfully, we now have access to intelligent professional analysts who are paid to sit around reading reports and picking stocks all day.

MOAT ETF tracks the Morningstar Wide Moat Focus Index which was created to identify listed companies with strong moats. Identifying moats is more of an art than a science which makes the process very subjective. In order to ease the selection process, Morningstar created an Economic Moat rating which serves as a framework for its analysts.

At the point of writing, the VanEck Morningstar Wide Moat ETF invests in 49 companies with companies like Meta Platforms, Microsoft and Alphabet in its top 10 holdings.

And the best part?

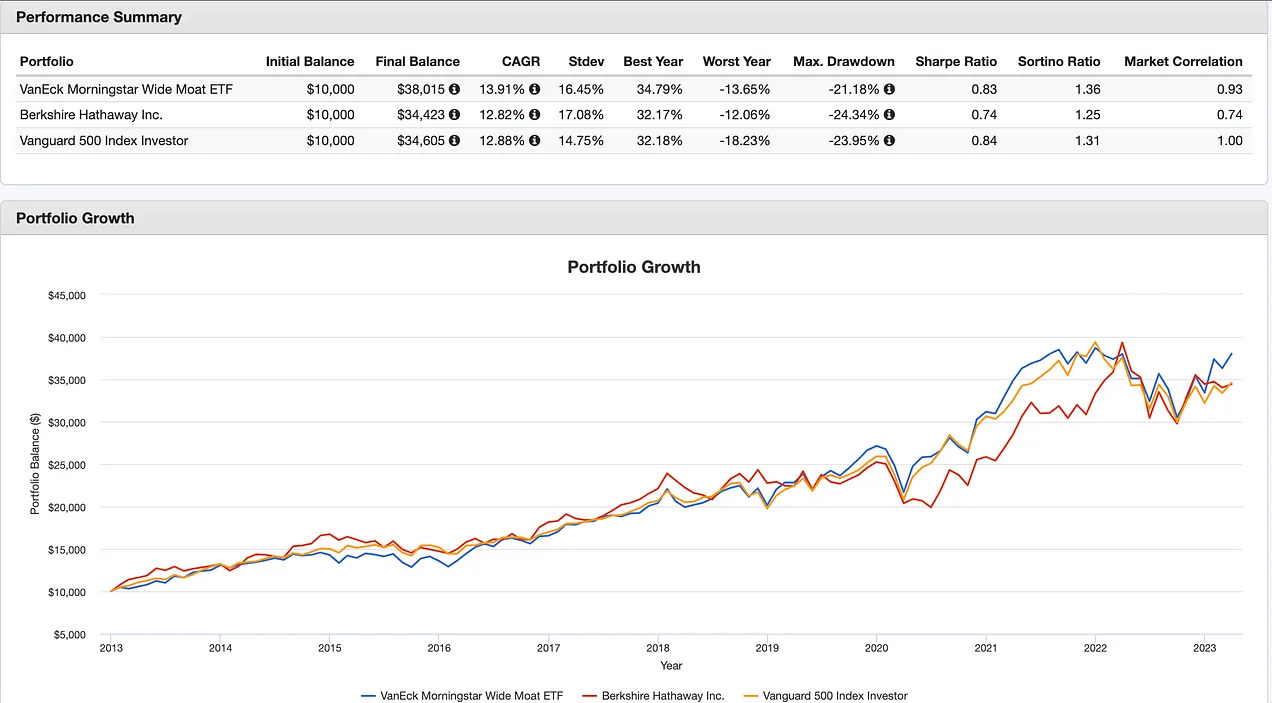

Between 2013 to 2023, MOAT delivered an annual return of 13.9% which beat Warren Buffett’s 12.8%!

And it's no fluke.

This outperformance persisted over years. Just take a look at the blue line to see how MOAT performed against VOO (Yellow) and Warren Buffett’s Berkshire Hathaway (Red):

There’s a bonus too!

It also takes on less downside risk than Buffett, experiencing a lower drawdown of 21% as compared to Berkshire Hathaway’s 24.34%.

But before you get ahead of yourself, let’s talk about the fees because no one works for free:

ETFs commonly charge an annual fee (aka expense ratio) that helps to cover expenditure of running the fund, pay the fund managers, plus a little more.

MOAT’s total expense ratio is 0.46% - this means you’ll pay a 0.46% fee on your portfolio value annually.

While this is higher than VOO’s 0.03% and SPY’s 0.09% (both VOO and SPY are ETFs tracking the S&P500), it is still reasonable given that you can ride on the expertise of Morningstar’s analysts and most importantly, get to keep your job while beating Warren Buffett’s track record.