Is a "Half Crypto, Half ETF" portfolio for me?

ETFs make stock investing easy.

But when it comes to crypto, there isn't a similar product that offers diversification and ease of access...yet.

While Blackrock and friends try to get their Bitcoin ETFs sorted, you may be wondering:

Is a "Half Crypto, Half ETF" portfolio for me?

There's no one-size-fit-all answer to this question. Afterall, the "just graduated" me would have a very different take from the current me who is writing this.

And so would you.

Here're some questions to help you determine if a "Half Crypto, Half ETF" portfolio is right for you instead:

1) Do you even believe in the crypto thesis?

If you don’t believe that crypto will play a prominent role in future, don’t invest in it because of FOMO.

(and you can skip the rest of this post too😅)

2) Are you in it for the long term? 👴👵

The first factor to consider would be to determine if you are seeking long-term growth or short-term gains. You should also consider your financial goals and time horizon for achieving them.

Are you trying to grow your excess income through investing, saving for a down payment on a house, or saving for retirement?

If you’re saving for the downpayment for your house, your investing runway would be shorter. Ideally you wouldn’t want to take on too much risk nor deal with high volatility either. It would suck if the markets are down just when you need the money to pay for your house. You would do better just putting your money into a high interest savings account or a money market fund.

On the other hand, if you’re saving for retirement, you would have a longer timeline. While I’m not saying that you can take more risks, having a longer timeline means that your portfolio would have the luxury of time to recover if the markets undergo a major correction.

(and of course, if you’re looking for dividend income 💰💰, this portfolio shouldn’t even be a consideration. explore some Dividend Zombies instead.)

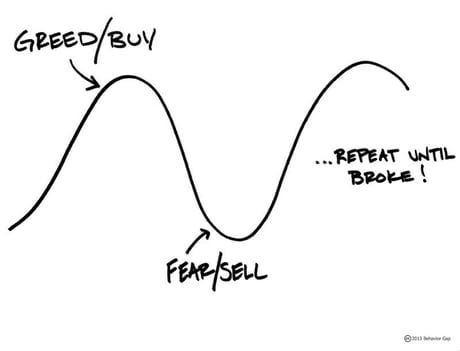

📉And let’s be frank: you’ll undergo a couple more bear markets in the coming decades. If you’re going to be investing, you’ll have to learn to deal with it.

Which leads us to the next question:

3) What’s your risk tolerance?

You should assess how comfortable you are with the risk of losing money, taking into account your past investment experience and its impact on your mental health. You should also consider your financial situation and determine whether you can afford to take on more risk.

Now, I know everyone talks about risk tolerance, but no one really talks about it in detail.

An easier way to gauge your risk tolerance is to ask yourself:

🤔Will I have trouble sleeping at night if I know the markets are down 50%, and so is my investment capital?

🤔Will I keep checking my brokerage account every hour and let the green or red number on the account affect my daily mood?

🛑If you answer yes to any of the above, the "Half Crypto, Half ETF" portfolio isn’t for you.

Instead, just stick to a ETF portfolio, invest on a quarterly or biannual basis and only look at your brokerage account when you put in more capital. (Read this to learn how to build a stress-free ETF portfolio instead)

Don’t let investing destroy your mental health 🧠

Be prepared for market cycles! 🌀

If anything, the last bear cycle has reiterated that markets are not “up only”. You should assess your view of the current market environment and your understanding of the economic and political factors that affect the markets.

Pros and Cons of a "Half Crypto, Half ETF" portfolio

When considering a "half crypto, half ETF" portfolio, you should also be aware of the pros and cons of both options.

✅Cryptocurrencies offer exposure to a high-risk, high-reward asset class with potential significant gains.

❌However, they are known for their volatility, and sharp price swings may result in substantial losses.

✅On the other hand, ETFs can provide diversified exposure to the broader market or specific sectors with lower volatility.

❌But you would be unlikely to beat the markets with ETFs.

It's important to remember that both cryptocurrencies and ETFs are subject to market volatility and losses!

✒️Thanks for reading TBH ’s Substack! We write about stocks, ETFs and finance honestly. If you enjoy today’s article, do subscribe:

How did a "Half Crypto, Half ETF" portfolio perform historically?

Like you, I can’t foresee the future. 🔮

But, we can look at what had happened in the past for some clues. 🔍

Building a "Half Crypto, Half ETF" can become very complicated depending on your choice of assets. Here, I used Bitcoin and SPY as proxies of a "Half Crypto, Half ETF" portfolio to get a general sensing of how it would have performed historically, across different durations.

If you had invested $10,000 in January 2021, you would have earned a profit of $2,738 at the point of writing. However, this portfolio carries a significant risk of drawdown, with a potential loss of up to -49.49%. Hence, it may not be suitable for investors with low risk tolerance.

Of course, when it comes to investing, time in the market plays a big role.

If you had launched such a portfolio during the market highs in Jan 2022, your portfolio would still be down -$1,149.

This loss is due to the bear market that hit both crypto and stocks in the late 2022.

Which brings us back to question no. 2 mentioned above.

It would be a horrible scenario, if you needed to cash out and pay for your house in today’s markets.

However, if you are in it for the long term, you shouldn’t be too worried about the drawdown. Because markets tend to recover.

In fact, Bitcoin has undergone several cycles thus far. Let’s take a look at how you’d be doing if you had built this portfolio in the highs of Dec 2017, just before Bitcoin crashed during the first major crypto winter.

No surprises, you’d still be up by $27,833, despite the recent market crashes:

Of course, there are caveats here, including having the guts to hold onto your Bitcoin and SPY through the market crashes!

So, is a "Half Crypto, Half ETF" portfolio for you?

In conclusion, the best investment portfolio for you depends on your investment objectives, risk tolerance, and time horizon. And, do remember to consider your personal financial situation and seek professional financial advice before making any investment decisions.

While short-term fluctuations may result in losses, a well-diversified portfolio with a long-term investment horizon can potentially recover and provide returns over time. Especially if you have the foresight and guts to not buy high and sell low.

👋Thanks for reading! tbh.finance writes about stocks, ETFs and finance honestly. If you enjoy today’s article, do share it with your friends.

If you hated it, hit reply and let us know!