Merck buys Prometheus Biosciences for $10.8Bn: Shareholders Win Big

offer price is 75% higher than its last traded price!

Prometheus Biosciences (NASDAQ:RXDX) develops treatments for inflammatory bowel disease (IBD) and other immune-mediated diseases.

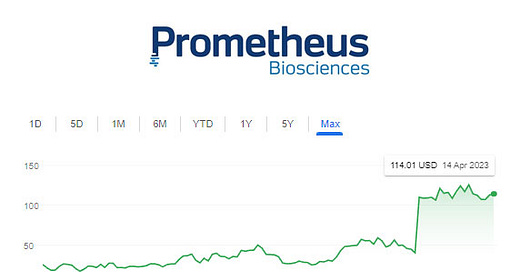

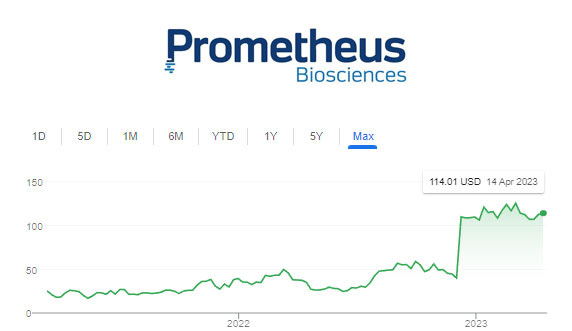

They went public not too long ago, back in March 2021 at $19 a share.

But get this, their share price has skyrocketed since then - thanks to a strong pipeline and some great clinical trial results, now their shares are trading at around $114!

Pretty impressive, right?

It gets better - Merck is now offering shareholders $200 per share to buy up Prometheus Biosciences!

Why is Merck giving RXDX shareholders a 75% premium?!

The market for autoimmune diseases is growing rapidly at a rate of 11.2% per year, and is expected to reach almost $91 billion by 2024. However, the cost of developing new drugs is extremely high - according to Deloitte, it averages at $2.3 billion per drug!

Instead of developing drugs from scratch, Merck’s move to buy up Prometheus gives it direct access to RXDX’s pipeline of immunology drugs.

So, instead of gambling a whopping $11 billion on creating new drugs, it just makes more sense for Merck to acquire Prometheus, especially since Prometheus already has three potential therapies in the final stages of clinical trials.

Honestly, Merck really needs to expand their portfolio. They've got some potential drugs in the works, but they're also facing a major revenue loss due to the expiration of key drug patents.

For example, their patent on Keytruda - a cancer immunotherapy - is set to expire in 2028. Keytruda currently makes up 40% of their total drug sales, bringing in $20.9 billion in sales in 2022 alone!

Merck's patent on Januvia/Janumet, a Type 2 diabetes drug that's actually their fourth best-selling drug, is also set to expire in 2023. It currently contributes about 0.9% of their total sales.

Congratulations, RXDX holders!

Merck is reportedly offering to pay for RXDX in cash at $200 per share, which is an impressive 75% premium compared to RXDX's pre-market price of $114 as of April 17th, 2023.

Before we get too excited, though, it's important to note that the deal is not finalized and still needs approval from regulators.

More opportunities ahead?

Merck’s competitor, Pfizer had recently confirmed a $43 billion deal for a cancer focused company, Seagen.

Together, these deals signal a growing trend of acquisition by big pharmaceutical companies as they attempt to remain competitive.

But before you rush off to buy some biopharma stocks on the cheap, it's important to realize that there are over 348 biotech stocks out there to choose from. So, picking the next big winner might be a pretty tough call.