New to investing? Here's how to build a winning portfolio, in 3 steps.

It's all about keeping it simple.

Anyone can build a stock-bond portfolio to achieve safe and reasonable returns of 5% – 10% depending on your allocation and market conditions.

However, your financial situation is unique and thus there is no one-size-fit-all portfolio.

So…

Here’s how you can customize your own winning portfolio, without having to take a degree in finance.

1) Establish your stock-bond allocation based on your risk tolerance

First, you need to understand your risk tolerance.

The simplest way to do this is to ask yourself this question:

“How much can I lose if the stock market goes down?”

The higher this number, the higher your risk tolerance, and vice versa.

Overestimating potential gains and underestimating risks can lead to painful investment losses, so managing risk carefully is crucial for profitability.

Once you have clarity on your risk tolerance, you can allocate a percentage of your portfolio to stocks and bonds, with a higher allocation to bonds for those who cannot tolerate much risk.

It's worth noting that the stock market tends to perform inversely to the bond market, so bonds can provide a buffer during stock market downturns.

Now that you have an idea of your risk tolerance, choose the losses you are willing to swallow from the chart:

If you're comfortable with a 30% loss, you should invest 70% in stocks and 30% in bonds. Alternatively, if you're only comfortable with a 10% loss, you should have 20% in stocks and 80% in bonds.

However, keep in mind that this is just a suggestion, not a strict rule.

Also, traditional investing experts would suggest increasing your bond allocation as you age. For instance, if you're 30 years old and have 30% of your portfolio in bonds, it's recommended that you increase it to 35% once you turn 35.

Regardless, remember that it's crucial to understand how much risk you can handle.

2) Pick the right ETFs

As a new investor, selecting individual stocks or bonds can be daunting. Hence, I usually encourage new investors to go with exchange-traded funds (ETFs).

However, not all ETFs are created equal, and picking the wrong index could result in significant losses.

So, here’s:

How to select the best ETFs?

Lower expense ratio: the lower the expense ratio, the better ROI.

Bigger fund size. Choose bigger ETFs as they tend to have lower expense ratios and greater longevity due to economies of scale.

Cash ETFs > Synthetic ETFs. Cash ETFs directly invest in the assets that make up the index, while Synthetic ETFs use derivatives to replicate the index, making them riskier for beginners.

Fund manager’s reputation. Research the reputation and credibility of the fund manager before investing in an ETF.

Index reputation – Stick to mainstream indices like FTSE, MSCI, and SPDR and avoid niche indices.

3) Rebalance at least once a year

As the saying goes, "what gets measured, gets improved." By reviewing your portfolio's performance and taking action to rebalance it, you can realize your capital gains every year.

It's not enough to build a portfolio and let it run on autopilot. Rebalancing is crucial to maintaining your target stock-bond allocation and realizing gains.

Just like how companies have annual general meetings and organizations have financial audits, it's necessary to review your portfolio annually to know exactly how much you've gained.

It's important to rebalance your portfolio at least once a year!

Need More Inspiration? Here’re some examples

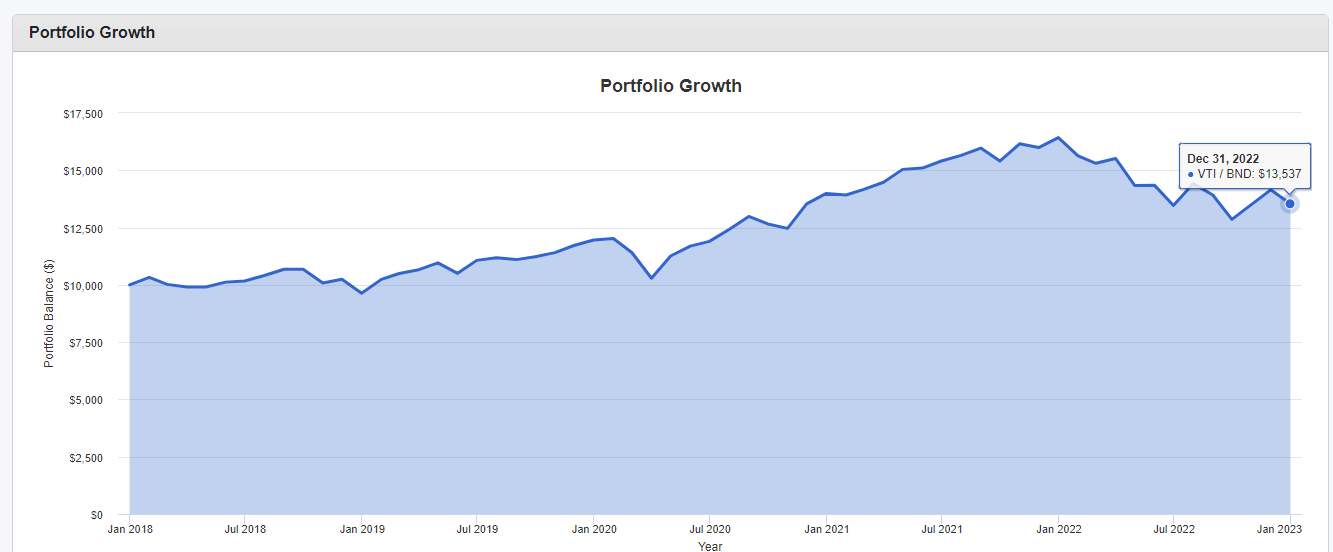

If you prefer to invest in the US markets, this would give you broad exposure to both the U.S. stock and bond markets:

Vanguard Total Stock Market ETF (VTI) - This ETF tracks the performance of the entire U.S. stock market by investing in a diverse range of companies across various sectors.

Vanguard Total Bond Market ETF (BND) - This ETF provides exposure to the entire U.S. bond market by investing in a range of fixed-income securities, including U.S. government, corporate, and municipal bonds.

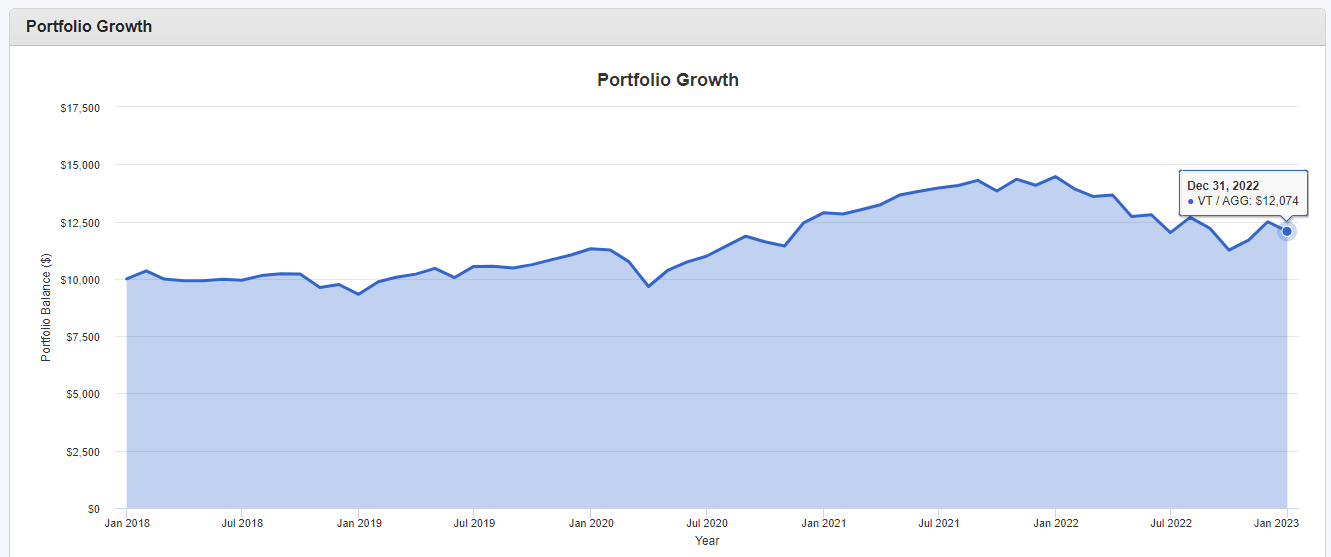

And if you prefer to have exposure to the global markets, here’s another 2-fund portfolio to consider:

Vanguard Total World Stock ETF (VT) - This ETF tracks the performance of the FTSE Global All Cap Index, which includes stocks of companies located in developed and emerging markets around the world.

iShares Core U.S. Aggregate Bond ETF (AGG) - This ETF tracks the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, which includes a broad range of U.S. investment-grade bonds.

By investing in these two funds, you would have exposure to both global stocks and U.S. bonds, providing a diversified portfolio with a mix of both equity and fixed income assets.

I’ve used a 70% stocks to 30% bonds allocation in the examples above, feel free to customize them based on your requirements.

Note: In the current markets, the stock-and-bond portfolio had suffered a double blow. However, this should be a short term phenomenon.

tl;dr

Building a winning portfolio doesn't have to be complicated. You can create a portfolio that works for your unique financial situation in just 3 steps, even if you’re a beginner:

Determine your portfolio allocation by understanding your risk tolerance and deciding on the percentage allocation of your stocks and bonds.

Choose the right ETFs by looking for lower expense ratios, bigger fund size, cash ETFs, reputable fund managers, and well-established indices.

Rebalance your portfolio at least once a year to realize your capital gains and maintain your target stock-bond allocation.

By implementing these steps, you can create a winning portfolio that helps you achieve your financial goals while minimizing risk and maximizing returns.

Remember, investing is a long-term game, so be patient, stay disciplined, and keep learning along the way.

P.S. get our free guide & design your own process to manage your money with ease.