Palantir Up 20% After Beating Earnings - Is it Time to Buy the Stock?

(and what the chart tells us)

Palantir (PLTR) earnings report resulted in a remarkable 20% surge in its stock price within a single day.

What happened?

In a nutshell, Palantir saw a notable growth in their commercial revenue.

After being labeled as a “not a real company” and a “bluff artist”, does its latest earnings suggest that tides are turning for Palantir?

Let’s dive into Palantir’s key financial indicators, interesting technical patterns in their charts and my perspective as a shareholder to help you decide if you should get in today.

Palantir reports strong 1Q23

Firstly, Palantir achieved an impressive 18% year-on-year growth in revenue, which validates the CEO's previous statements and indicates the company's strong performance.

Surpassing analysts' expectations of $506 million, Palantir's revenue reached $525 million.

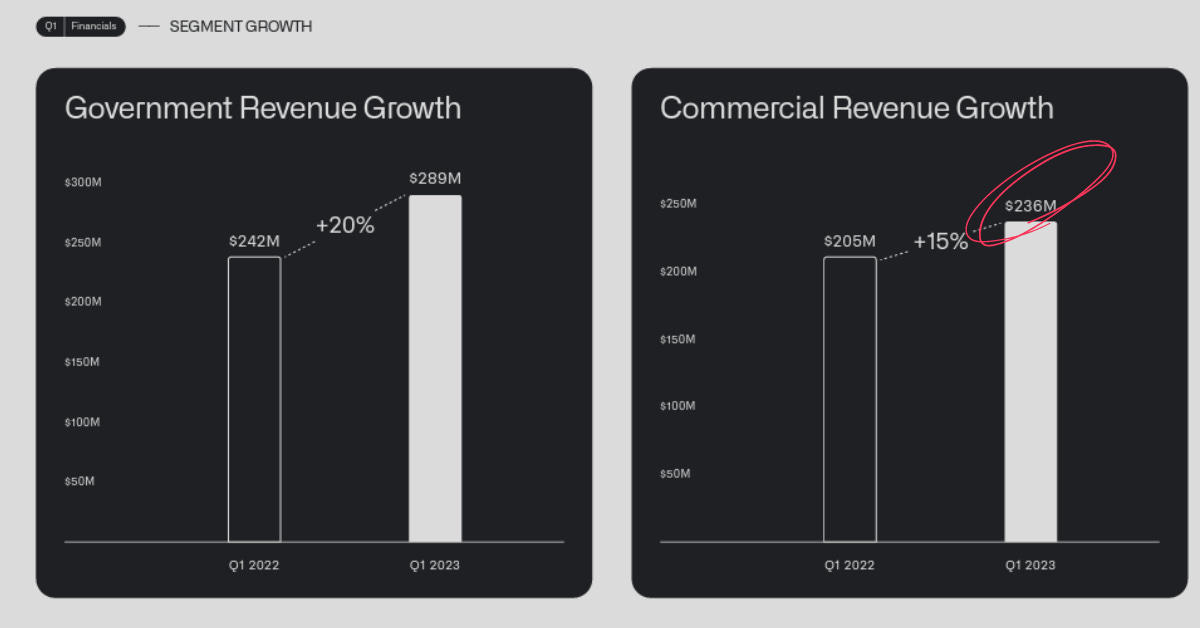

One of the biggest worries that investors have is whether Palantir can expand its market beyond the government sector.

This worry has been thoroughly dismissed with the company announcing a 15% year-on-year expansion of commercial revenue, demonstrating the company's successful entry into the private sector.

Notable firms, such as insurance companies, have embraced Palantir's products, contributing to its commercial revenue.

What does the chart tell us about Palantir?

From a technical analysis standpoint, Palantir has experienced a prolonged consolidation phase within a narrow range for at least 1.5 years. This suggest that investors are willing to buy in at a support level between $6 and $10:

Recently, a golden cross formation occurred with the 50-day moving average surpassing the 200-day moving average. This indicates a bullish trend.

With the recent 20% spike, the stock is likely to exhibit a stronger rally. Breaking and maintaining a position above the $10 level will be crucial for a potential shift in trajectory.

I share more details about my technical analysis here:

Palantir’s future looks bright but…

While the previous quarter's profitability was influenced by asset gains rather than normal business operations, this time the profitability is genuine.

However, it's important to consider some factors moving forward.

Alex Karp, Palantir’s CEO has set some really high expectations:

(quote) “We were profitable again this quarter... And we now anticipate that we will remain profitable each quarter through the end of the year”

There are several reasons why he is putting out such a bold statement;

There is speculation of Palantir's potential inclusion in the S&P, and investors are touting this as Palantir’s “Tesla'' moment. Such speculation could have a significant (but short term) bullish impact.

Palantir's newly released AI platform has garnered remarkable demand.

While that is a confidence booster for shareholders, you may want to take it with a pinch of salt.

By putting forth such a strong claim, Karp could potentially shoot himself in the foot if Palantir fails to remain profitable in any of the coming quarters. If this happens, the stock will definitely tank again.

My take as a Palantir shareholder

As a Palantir shareholder, I'm pleased with the company's performance.

Nevertheless, it's crucial to avoid overcommitting to a single stock. Diversification of one's portfolio and effective risk management are essential.

In pre-market trading (as of 10 May), the stock is up 17%, fluctuating between $9 and $9.30. It briefly touched $10 but had encountered resistance. If enough investors hold at $10, it could establish a strong support level.