Should Young People Buy Gold?

Is it a smart move for young investors to get into the gold game? 🤔

Is it a smart move for young investors to get into the gold game? Let's break it down and figure out if buying gold should be on your financial radar.

Gold is frequently seen as a reliable addition for diversifying your investment mix, thanks to its stability and performance relative to other markets. This precious metal tends to shine, particularly during times of economic turbulence, economic downturns, and when inflation is on the rise.

However, just like with any investment, you can make the most of gold when you have a clear grasp of how it aligns with your broader financial strategy. It's all about making a smart and well-thought-out allocation, rather than making decisions out of fear. Therefore, let’s look at its pros and cons of investing in gold.

Advantages of Investing in Gold

Inflation Hedge

Gold acts as a protective shield against the eroding effects of inflation. As inflation rates climb, the purchasing power of your money diminishes. In contrast, gold frequently experiences appreciation in value during periods of inflation.

For example in 2022, the demand for gold increased 12% year over year. Consumer prices surged 9.1% over the 12 months that ended in June 2022. Research shows spanning from 1974 to 2008 highlights eight years characterized by elevated inflation in the United States. During those phases, gold prices exhibited an average annual increase of 14.9%.

Safe Haven in Economic Turmoil

Gold can be a safe haven asset during times of economic uncertainty. It has the potential to increase in value when economic conditions become uncertain or unstable. An analysis conducted by the Federal Reserve Bank of Chicago, which compared gold prices to a University of Michigan study of consumer expectations, found a positive correlation between the price of gold and the proportion of consumers with pessimistic expectations. While gold may not always rise during economic downturns, it can provide a sense of security for those who plan ahead.

Diversification

Investors also opt to include gold in their portfolios as a means of diversification. By incorporating gold into your investment strategy, it can provide a layer of protection against inflation, economic uncertainty, and risk, making it a valuable asset for those seeking to build a well-rounded and resilient portfolio. However, it's essential to carefully assess your individual financial goals and circumstances before making any investment decisions, as gold, like any asset, comes with its own set of risks and considerations.

Disadvantages of Investing in Gold

Performance over time

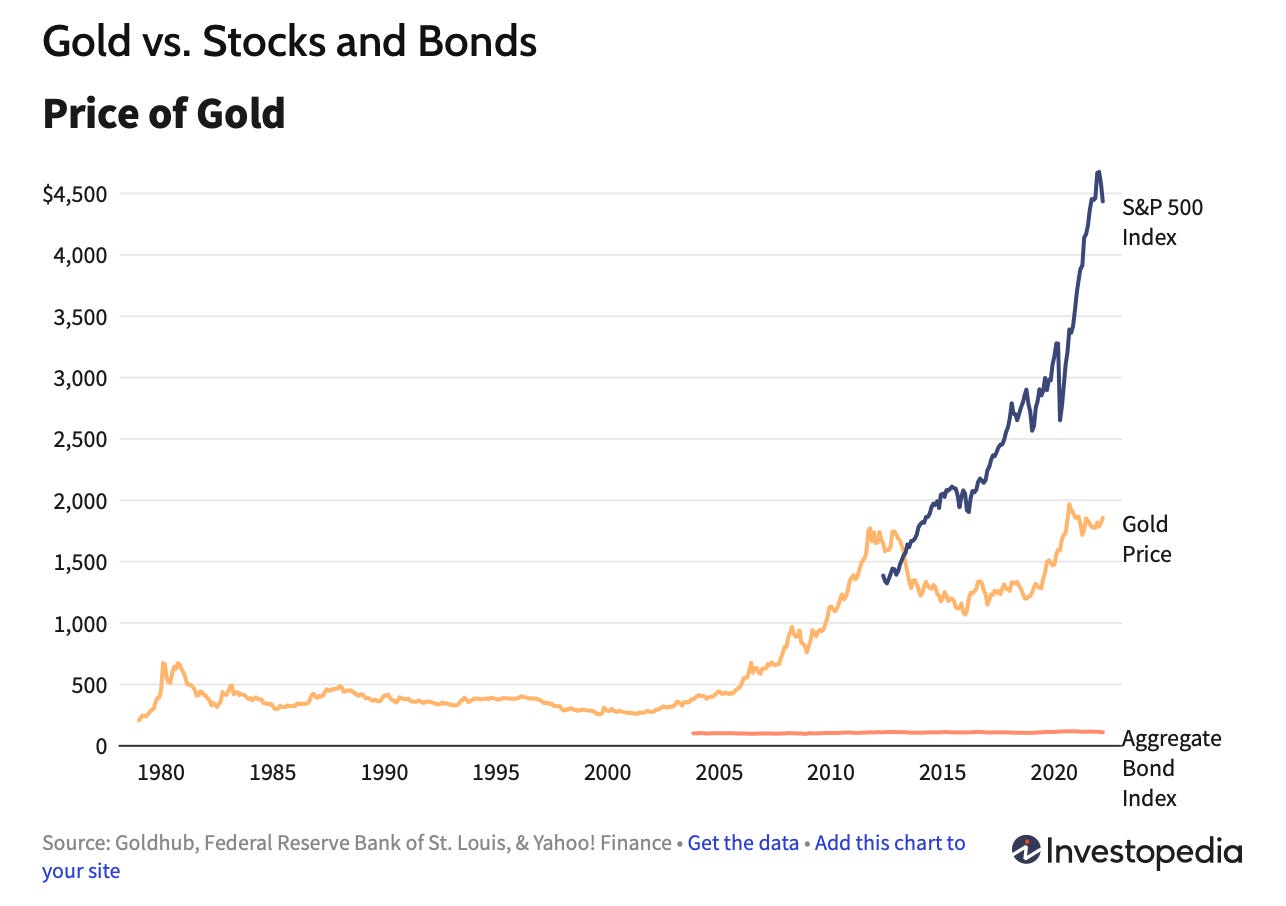

When assessing gold's performance as an investment in the long run, it truly hinges on the specific time frame under consideration. Example, From 1990 to 2020, the price of gold saw an approximate 360% increase. During this same timeframe, the Dow Jones Industrial Average (DJIA) recorded a significant gain of 991%. However, if you shifting our focus to the 15-year period spanning from 2005 to 2020, we observe a 330% rise in the price of gold, which is quite similar to the 30-year span previously mentioned. Hence, when adopting a long-term perspective, gold may not consistently surpass the performance of stocks and bonds, although there are instances where it does so.

Investment that thrive by fear

It's common for people to turn to gold only when the markets become uncertain, leading to decisions based on fear rather than sound long-term planning. This behavior is undoubtedly one of the factors behind gold reaching an all-time high of $2,074.88 per ounce in August 2020 during the height of the COVID-19 pandemic, before subsequently stabilizing.

Conclusion: Buy or Not Buy?

In summary, the decision to invest in gold boils down to aligning with your investment goals and having a clear understanding of your risk tolerance and investment horizon.

Personally, I haven't included gold in my portfolio yet, but I might consider it in the future, especially if prices decrease. I believe that gold can play a role in a diversified investment strategy, but it shouldn't dominate the entire portfolio. Additionally, gold can take the form of physical items like fashion pieces, which can be a win-win situation in terms of both investment and style.

Great article!