Tesla Q4 results: Good, meh or bad?

It is earnings season once again and Tesla has just released its Q4 results yesterday.

Let's discuss:

1. Headlines said record revenue and profits. It should be the case considering that Tesla is still a fast growing company with lots of market share to capture. EV sales are still a fraction of internal combustion engines and Tesla will continue to benefit from the ICE-to-EV transition in the next few decades. We won't be surprised if Tesla continue to report record revenue and profits in future quarters.

2. What is more important is the growth rate and the market share. It is still impressive for Tesla to grow its revenue by 37% given its size and amidst an economic slowdown. As for market share, BYD has already unseat Tesla as the best selling EV brand in the world. There are more competitors coming up and that is one of the main concerns of investors.

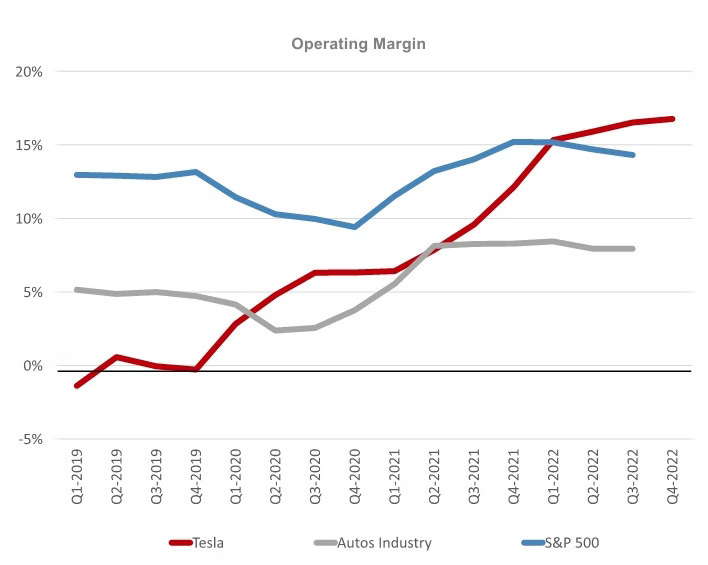

3. But margins are important too. BYD automobile segment's net profit margin was only about 3.5% while Tesla did 16% for the same period (1H2022). Tesla has also surpassed the auto industry operating margin since 2021. This is the true power of Tesla. The branding is strong enough to put out a high price tag and get people to buy. Similar to Apple - Tesla doesn't just sell a product, it sells the aura.

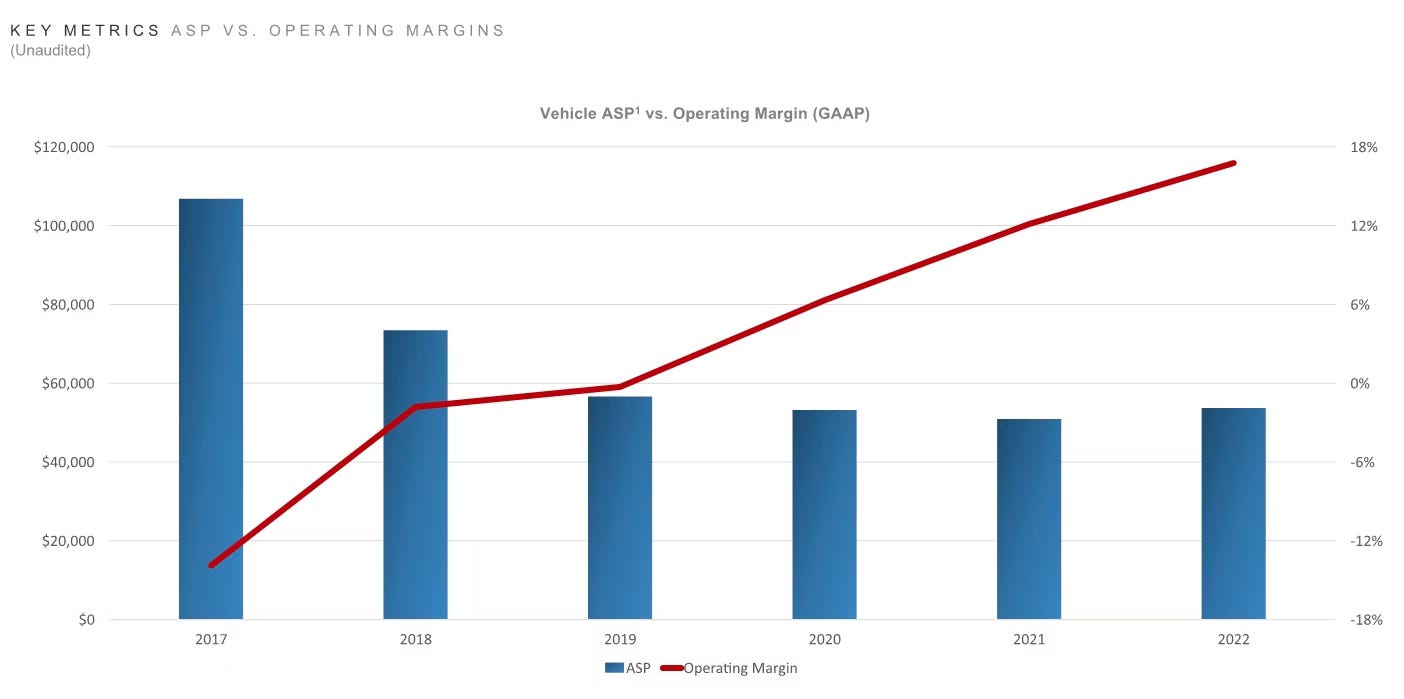

4. Yes, Tesla is cutting its prices and many think it is because Tesla is in trouble due to overwhelming competition, and wanted to boost sales. But Tesla has been cutting prices each year and the average selling price (ASP) has been falling. This is necessary if you want EV adoption by the mass market, the prices must go low enough for most people to afford. Prices will continue to fall.

5. Despite cutting prices, Tesla's operating margin continue to improve. This is possible because Tesla has been gaining economies of scale as it expands its production as well as disciplined cost cutting measures. It is very easy to be aggressive and ignore costs when growth is high and competition is rife. It is a good sign that the management has not lost sight on prudence.

6. Tesla has been growing its profits and its cash flow such that it is sitting on $22 billion cash. It has minimal debt. The financial position is strong to weather a potential recession. Musk has also said that Tesla is likely to carry out a share buyback in 2023. A repurchase of $5-10 billion range is possible. This should appease the shareholders who have been pressuring the company to do so.

7. Taking it altogether, we think that the results are good and we believe Tesla's prosperity lies in its ability to maintain the branding. As long as it can continue to sell the aura, it would rise above the competition. It doesn't need to sell the most number of cars (but prices are high and margins are fat), maintaining the brand recall for EV is of utmost importance.