👋Welcome to tbh.finance. Here, we write about stocks, ETFs and finance honestly. If you enjoy today’s article, do subscribe to receive more like this in your inbox.

I’ve been looking for a Value ETF 💰 that lets me invest without worrying about missing out on those “little-known” value stocks. This, I think would be the best value ETF (at least at the point of writing)

Let’s dive into it 👇

When value investing, we often use too many a plethora of metrics to try and measure companies up. Then, we try to invest in those that are trading below their ‘market value’.

But in business, survivability usually boils down to: 💵

To keep a business running, you need cash to pay employees, pay suppliers, pay rent, invest in new opportunities, and more.

Remove cash from their books, and any successful company would crumble.

👑Cash is King 👑

Instead of focusing on profits or earnings, you can use cash flow to find some of the best value stocks, using:

💸Free Cash Flow Yield (FCF Yield)

FCF is beautifully simple, it tells you how much cash a company has available to pay creditors and shareholders like you and me, if they were to halt their operations now.

The higher the Free Cash Flow, the better.

👀But how much FCF is enough?

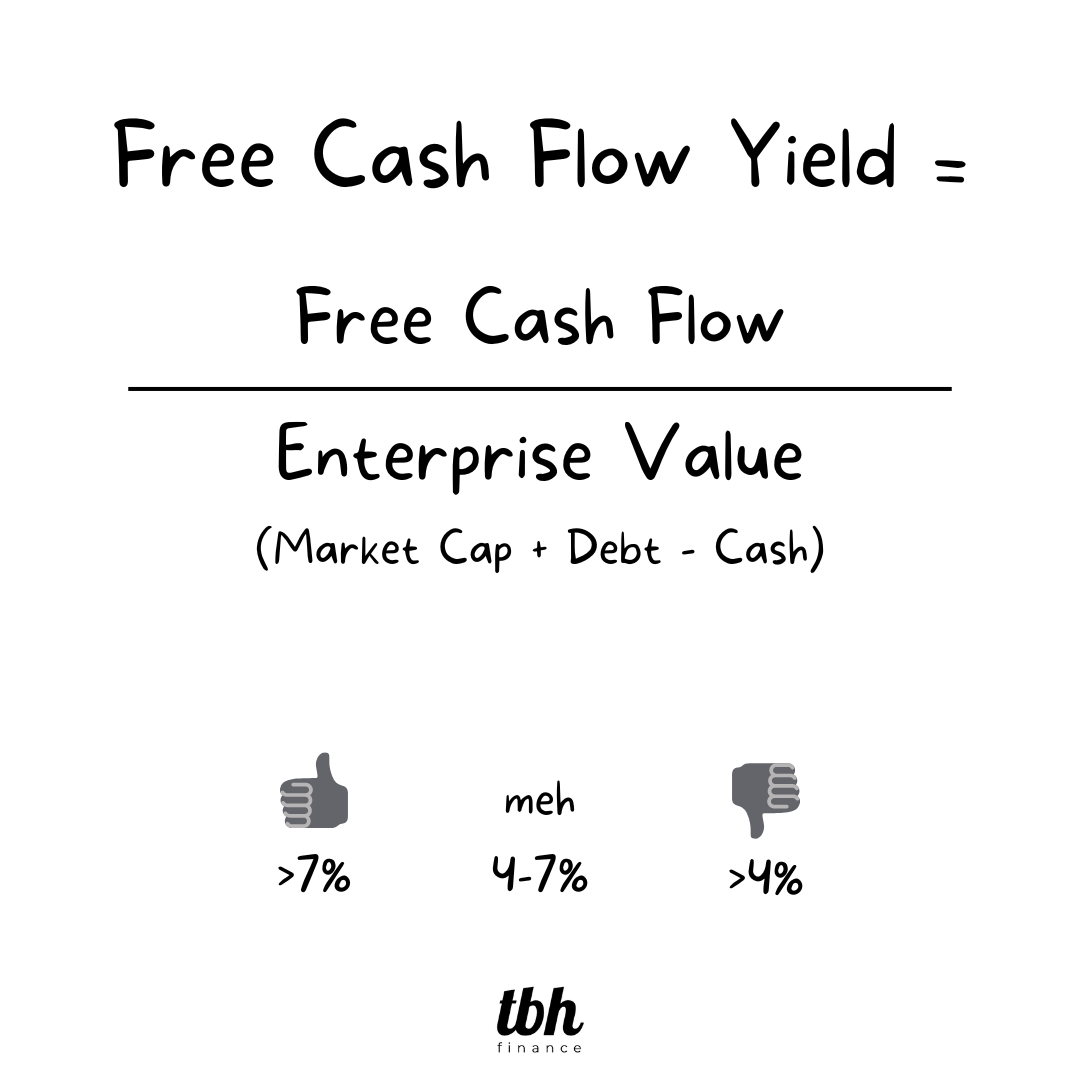

To find out, we can use FCF Yield: FCF divided by Enterprise Value.

FCF Yield gives us an idea of whether a stock is undervalued, based on its cashflows.

In general;

👍: >7% FCF yield

👎: <4% FCF yield

If you’re curious about the 📖definition:

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

Investopedia

and onto the Best Value ETF:

🐮Pacer US Cash Cows 100 ETF (COWZ)

COWZ gives us exposure to US stocks with the highest free cash flow yields.

It ranks the 1,000 largest stocks in the US (from the Russel 1000 Index) by free cash flow yield, and invests in the top 100 companies based on the trailing twelve month FCF yield.

Instead of weighing components by market cap, COWZ will weigh 100 companies by Free Cash Flow.

What’re you really investing in 🐮?

Here’re COWZ’s top 10 holdings at the point of writing:

MCKESSON CORP (MCK): 2.44%

ZILLOW GROUP (Z): 2.27%

CISCO SYS (CSCO): 2.20%

BUILDERS FIRSTSOURCE (BLDR): 2.19%

PIONEER NAT RES (PXD): 2.15%

BOOKING HOLDINGS (BKNG): 2.14%

OCCIDENTAL (OXY): 2.09%

ALTRIA GROUP (MO): 2.08%

GILEAD SCIENCES (GILD): 2.07%

LENNAR CORP (LEN): 2.05%

You’ll notice that these stocks are mature (sometimes boring) companies like McKesson, Lennar, Chevron and Pioneer Nat Res.

You may not pick up any of these stocks if you’re only looking for value stock ideas using metrics like P/B, P/E, EV/EBIT, etc.

Heck, you might never even stumble on some of these tickers if you look for investment ideas on the news, on Reddit, or on Twitter…🫠

So…why not:

💡Use COWZ to find value stock ideas

You can easily access the full COWZ portfolio here and start analyzing the top 100 high cash flow yields US stocks.

Layer on your desired metrics to narrow down the selection of stocks.

Regardless of the stocks you end up with, at least you know that they are fundamentally strong in terms of their cash flow.

If you’re curious, you can also get the free cash flow yield data for each stock from sites like Macrotrends, YCharts, financecharts and more.

🛑Before you 🙄…

I admit that the expense ratio of COWZ is on the higher end at 0.49%, especially if you’re used to fees from SPY (0.0945%), VT (0.02%) and the likes.

However, given that COWZ offers a way to save research time and covers stocks that might never enter our realm of consideration, 0.49% feels fair.

Of course, you can also use COWZ to find value stock ideas.

And if you’re still not satisfied, here’s a comparison against two other Value ETFs that almost made the list:

📈If you prefer a graphical view: