I’ve always wanted to visit Japan and that desire only grew stronger while I was trapped at home during the Covid lockdown. Hence, I decided to learn Japanese.

And that was when I first stumbled upon Duolingo (NYSE:DUOL).

I wasn’t alone.

Between 2020 to 2023, Duolingo grew its user base by 64%:

What is Duolingo?

Duolingo is a language education technology company that helps people to learn new languages, for free since 2011. Some of its early investors include Tim Ferriss, Ashton Kutcher and Google Capital.

Its co-founder and now CEO, Luis von Ahn is not new to the startup scene. He had sold his previous company, reCAPTCHA to Google prior to launching Duolingo.

Duolingo started off with a bang in 2011 when it had accumulated a huge waiting list of over 500,000 people prior to its public launch.

After undergoing several rounds of fundings, Duolingo went public on 28 July 2021, in the height of the bull market.

It closed +36% on its first day of trading, and subsequently hit an all time high of 199.37 in Sep 2021 before the bear market wiped those gains out in 2022.

Silently delivering 90%+ year-to-date!

Unlike many growth stocks that are still struggling today, DUOL continued to post strong growth results and has delivered 90%+ returns year to date. (Comparatively, the First Trust Cloud Computing ETF (SKYY) delivered just 13.6%.)

What gives?

Strong growth despite fearful macro sentiments

Despite the poor macro sentiments, Duolingo has bucked the trend by avoiding layoffs. By controlling their marketing costs, and improving their gamification styled education system, DUOL continued to post strong growth figures of 43% growth in Monthly Active Users and 68% more paid subscribers in 2022:

They have also continued to outperform earning expectations time and again:

Introducing new revenue streams

Hopping on the AI hypewagon?

While the company continues to innovate, it has launched a brand new subscription tier “Duolingo Max” on 14 March 2023.

This new subscription tier is a GPT-4 powered chatbot that includes all the previous paid tier features as well as access to a chatbot that allows users to practice interacting in their selected language, with a bot.

Moving beyond language education

Duolingo had also launched the Duolingo Math app in selected countries in October 2022.

Although it doesn’t offer a paid subscription currently, it could open up another revenue stream in the future, especially if the company manages to work directly with schools and teachers.

Well, it sounds like Duolingo has everything going for it.

But wait a minute, although I’m a daily user, I don’t feel the need to pay for Duolingo’s paid tier.

Am I just a cheapskate, or do Duolingo’s prospects not as bright as it seems to be?

Duolingo’s woes

Low ratio of paying subscribers (find churn and renewal rates also)

Take a look at their user statistics again:

Although the number of paid subscribers grew by 68% in 2022, only 25.7% of daily active users are paying clients - that’s 1 in 4 users.

Guess what? I’m not the only miser.

But they can monetize free users with in-app advertisements right?

Yes they can, but the revenue isn’t much to cheer about.

75% of daily active users are free users, but advertising revenue only contributes 12% of DUOL’s total revenue.

While it seems that Duolingo can increase the value of paid customers with Duolingo Max, they would likely have to find new ways to convert more free users into paying subscribers once revenue growth stagnates.

Loss making

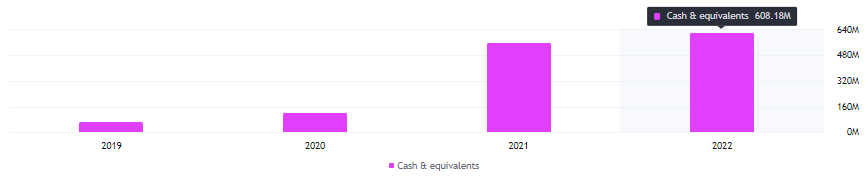

Duolingo has been posting great topline growth with 47.3% revenue growth in 2022 (see table above), 760% growth in free cash flow:

And, 47% growth in gross profit:

However, it is still loss making as it aggressively spends on product development and marketing.

Will DUOL earn a spot in my portfolio?

While DUOL has its troubles to deal with, the company has the track record of innovating for growth way before they were listed.

Their fundamentals remain strong despite being in losses - the company is actively growing its user base, and it has a growing cash reserve which currently is about 11% of its market cap.

And thanks to the bearish market sentiment, DUOL’s had undergone a good price correction.

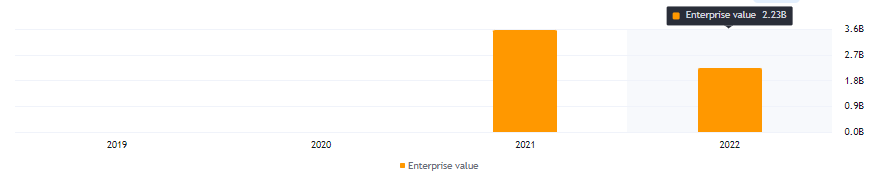

However, after its 90% run since Jan 2023, it is currently trading at a Price to Cash Flow ratio of 102

And its enterprise value is back up to 4.91B, which is higher than its 2021 levels.

It might be a little too late to hop on the wings of this green bird now.