U.S. Debt Ceiling ⌛💣?: Diversify beyond US with these 2 ETFs now

if you're worried about the risks

The U.S. debt ceiling negotiations creeping to a slow conclusion as default looms overhead.

If you’re looking to diversify your portfolio beyond the US markets, as a hedge against any possible negative impacts (though it’s unlikely), here are 2 international ETFs you can consider now.

But first;

Debt Ceiling 101

The Congress dictates the maximum amount of debt that the US government can take on - aka the debt ceiling.

The bad news; the US government’s debt is closing onto the debt ceiling. So, now they have to make a decision on whether to raise the debt ceiling or just let it be and default. (Here’s how the debt ceiling issue will impact you)

If your portfolio is currently heavy on US stocks, you may be thinking of diversifying your portfolio geographically.

2 ETFs to consider:

💡Vanguard FTSE All-World ex-US ETF (VEU)

VEU tracks the Vanguard FTSE All-World ex-US index which gives you exposure to stocks listed across developed and emerging markets across the world. VEU is the largest ETF on this list with an AUM of $51.3B and requires an expense ratio of 0.08%

At the point of writing it holds 3,713 stocks of which the top 5 include:

Nestle (Ticker: NESN)

Tencent Holdings (Ticker: 700)

Novo Nordisk (Ticker: NOVOB)

ASML Holdings (Ticker: ASML)

Taiwan Semiconductor Manufacturing (Ticker: 2330)

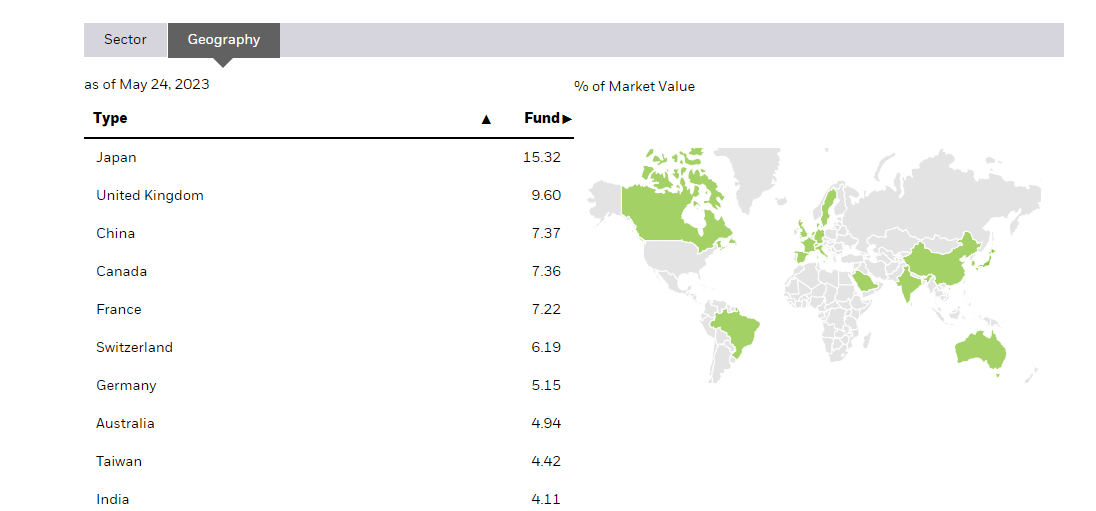

VEU’s portfolio is diversified across over 43 countries, with the top 10 being:

VEU is listed on the NYSE. Unfortunately there isn’t an international ETF without US exposure on the UK exchanges currently.

A close competitor to VEU is IXUS:

💡iShares Core MSCI Total International Stock ETF (IXUS):

iShares Core MSCI Total International Stock ETF gives you exposure to a portfolio of stocks listed across broad developed and emerging markets, for a low expense ratio (aka fee) of 0.07%.

IXUS has an AUM of US$31.6B. IXUS offers a portfolio with 4328 holdings of which the top 5 holdings include:

Taiwan Semiconductor Manufacturing (Ticker: 2330)

Nestle (Ticker: NESN)

ASML Holdings (Ticker: ASML)

Novo Nordisk (Ticker: NOVOB)

Tencent Holdings (Ticker: 700)

IXUS’s portfolio is diversified across over 19 countries, with the top 10 being:

IXUS is listed on NASDAQ.

Diversify!

I’ve shared 2 international (ex-US) ETFs that you can consider if you’re looking to diversify your portfolio geographically.

Of course, there are many others ways to diversify; you can diversify across asset classes by looking into fixed income (aka bonds), commodities, alternative assets like precious metals (gold, palladium), crypto, or property and more.

You can choose to explore them all, but remember your investment objective and only invest in things that you understand.