With Google upgrading Bard in its contest against ChatGPT, the AI hype doesn’t seem to be dwindling just yet.

If you’re an investor seeking to profit from the growth of AI, you might be looking for the best AI stocks.

But…

I wouldn’t be doing you justice if I fail to mention the potential risks of investing in Artificial Intelligence:

Most early innovators fail

AI is still in its early days and although it's expected to grow, there's a chance that some of today's AI companies may not survive this initial stage.

Some of the potential winners might not even be available for you to invest in simply because they are not listed publicly (for example, you cannot invest directly in OpenAI).

The current market may be overpriced

Thanks to the AI hype the current market may be overvalued. Current prices of AI stocks may collapse when the AI hype cools off.

Instead of trying to select the best AI stocks, it may be wiser to invest in AI-focused ETFs. These specialized ETFs provide exposure to a diversified basket of AI stocks, reducing the need to make a single, correct bet and minimizing potential losses if your bet is incorrect.

We compare three big AI ETFs:

Global X Robotics & Artificial Intelligence ETF (BOTZ)

The largest AI ETF based on its assets under management, BOTZ offers exposure to pure play robotics and AI companies that derive at least 50% of their revenues.

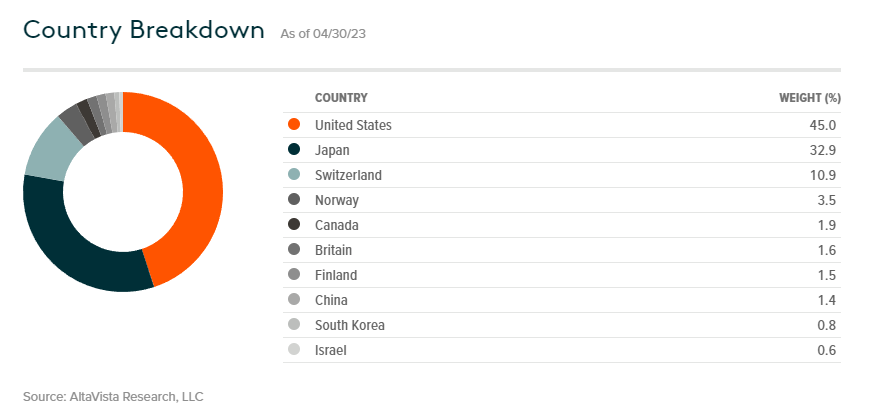

BOTZ gives you access to a global portfolio of AI companies, with US companies making up almost half of its portfolio:

This year’s AI hype has been good for BOTZ holders as BOTZ delivered 24.6% year-to-date:

Past results are not indicative of future returns.

However, if you’re bullish on the growth of artificial intelligence, you may want to watch this ETF.

ROBO Global Robotics and Automation Index ETF (ROBO)

ROBO is the oldest AI ETF on this list, and has the highest expense ratio.

It offers exposure to companies driving innovation in the fields of robotics, automation and artificial intelligence. These companies are listed in stock exchanges across the world, and like BOTZ, almost half of ROBO’s portfolio is made up of AI companies listed in the US:

Year-to-date, ROBO has delivered 14.6% returns:

Global X China Robotics and AI ETF (2807/9807)

Next on the list is the Global X China Robotics and AI ETF. Although it isn’t the biggest or oldest AI ETF, it made this list because it offers exposure to Chinese companies involved in the precision, automation and robotics value chain.

If you’re bullish about China’s role in the development of AI, start by researching this China AI ETF.

The Global X China Robotics and AI ETF has two tickers; 2807 is the ticker for the ETF trading in HKD, 9807 is the ticker for the USD variant. They are both listed on the Hong Kong Stock Exchange.

At the point of writing, these are the top 10 holdings in this China AI ETF:

Year-to-date, the Global X China Robotics and AI ETF has delivered 11.97% returns:

Before you jump onto this ETF, you should be comfortable with the volatility and nature of China markets.

Are you bullish on AI?

If you’ve read till here, I would think that you are.

I’ve shared three AI ETFs that you can use to ride the growth of AI. However remember that investing in AI can be risky as we do not know how the industry would evolve in the future. While it is likely that AI could become an integral part of the economy, the current enablers may not be future market leaders.

If you’re planning to invest in AI, do remember that this should be parked under the “high risk bet” portion of your portfolio. Do not put all your capital into a single bet! If you’re new to investing, read this and get this guide!