On a personal level, we need to manage our income, expenditure and savings to make sure that we have sufficient cash flow to survive in this harsh world.

Likewise, governments manage their spending too.

But, the US government doesn’t seem to be doing too well in this aspect; it has been losing an average of $1 trillion per year, since 2001. Which begs the question; where did the money to cover their spending over the past 12 years come from?

Well, they have been borrowing money.

But even the US government doesn’t have access to limitless blank cheques (or so they say…).

The Congress dictates the maximum amount of debt that the US government can take on - aka the debt ceiling.

The thing is, the debt ceiling moves. In fact, it has been increased 78 times historically:

So…

What happens if the US debt ceiling is breached?

If the US debt breaches the debt ceiling, the US would have to default on its debts.

If you and I go bankrupt, the bank would take everything we used to own and be done with it.

Things are on a bigger scale if the US goes bankrupt - in short, it could bring down the rest of the world’s economies.

Firstly, it could also trigger a recession and cause the loss of an estimated 3 million jobs.

Secondly, it would trigger a drop in consumer confidence which could cause investors to withdraw their money from the US financial system en masse.

This could lead to short term drops in the markets which will reflect in your portfolio.

Thirdly, if you own any US treasury bonds, these could go to zero. (especially if you own short term ones)

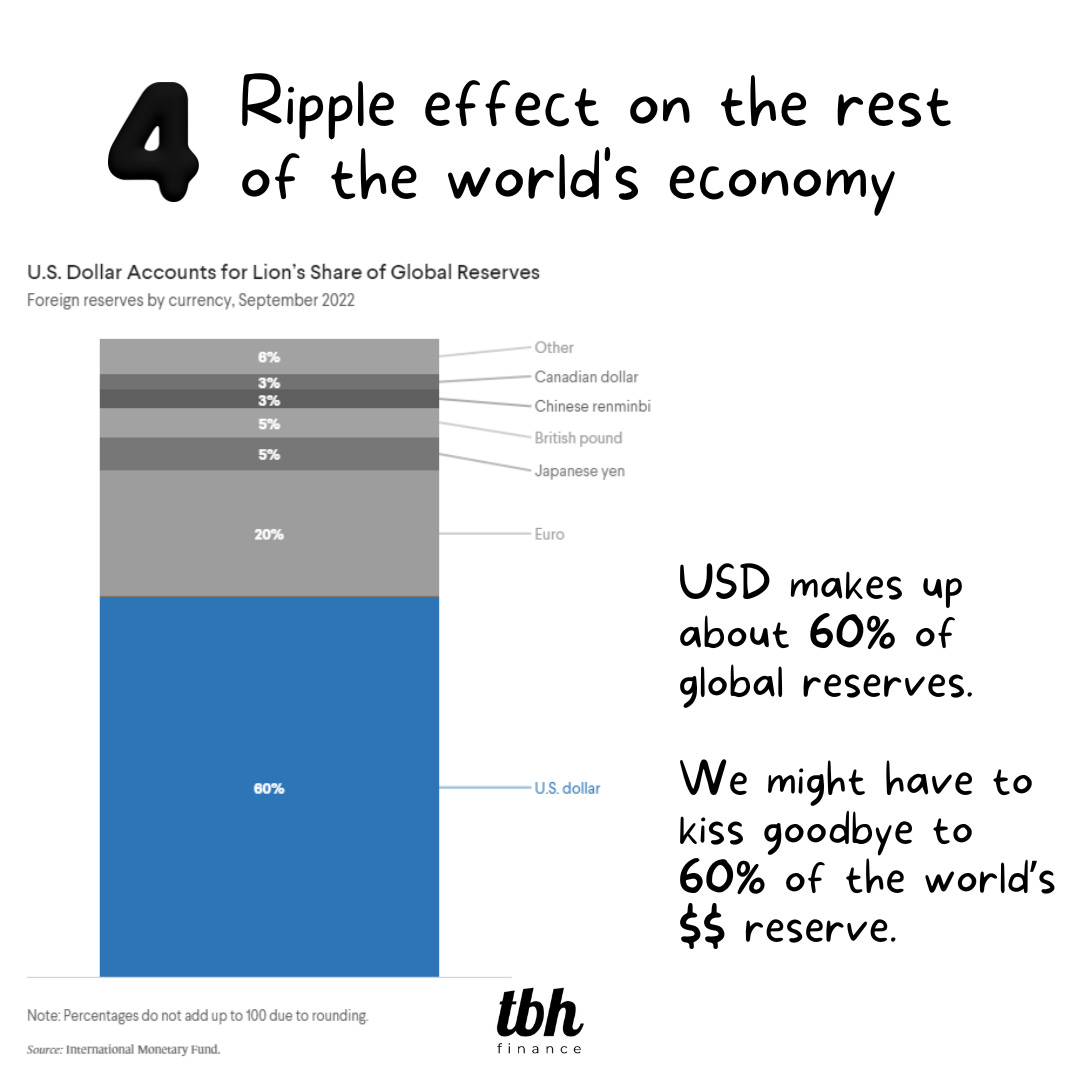

Last but definitely not least, USD makes up about 60% of global reserves. If the US were to default, the value of the US Dollar would crash and we can kiss goodbye to 60% of the world’s reserve.

Lower income countries that rely heavily on the US dollar will be hit the most as they would struggle to manage their own debts.

However, thus far, talks of raising the debt ceiling have been at a standstill. That said, we think it will likely be raised. We shared why here.

What can you do to protect your portfolio?

Don’t panic.

But strap in for a possibly volatile ride.

👉If you’re dollar cost averaging regularly, keep at it.

👉If you’re holding onto cash and are tempted to get into the markets due to the short term runs, you may want to hold off on the decision till later.

👉If you’re on leverage or playing with fire margin, it’s time to take your feet off the pedal now.

👉If your portfolio is overweighted on US stocks, consider diversifying.