No Love for Cramer's Ideas: LJIM Shuts Down in Only 9 Months! 🛑

The most common question asked about investing is probably “ how to valuate a company”. tbh, this process is quite the hassle and requires a good understanding of accounting language.

Personally, I hate it.

Why would I want to spend my free time after work to think about what company is good for investment?

Looking at how big investors could possibly double, triple the capital seems pretty enticing. Maybe copying trades is the way to go?

Building upon the idea to copy trades came the establishment of the Long Cramer Tracker ETF (Ticker symbol: LJIM) and Inverse Cramer Tracker ETF (Ticker symbol: SJIM).

What are the Cramer ETFs?

Built to attract investors to make money, these ETFs were launched to either follow or bet against Cramer’s stock picks.

They include:

LJIM: Long Cramer ETF that track the stocks which Cramer recommends. It was created to further question Cramer on the reasons for his choices. Current holdings include Nvidia, Meta Platforms Inc., Palantir Technologies Inc. , etc.

SJIM: Short Cramer ETF that goes against Cramer’s picks - it would either short Cramer’s picks or go long on the stocks and sectors that Cramer is negative on. Current holdings are Tesla, Inc. , Carvana Co. , Ford Motor Co. , etc.

To have an ETF built to track your portfolio, you definitely need to have serious skills.

So, who is Jim Cramer?

Jim Cramer formerly worked for Goldman Sachs for sales and trading. Subsequently, he started his own hedge fund named: Cramer, Berkowitz & Co. , that he claims to have generated a 24% average annual return over 14 years. If that were true, then he did better than the legendary Warren Buffet who makes an annualized average return of ~19.8% since 1965.

However, in spite of all these achievements, Cramer is notorious for his empty talks about stocks and oversimplifying investments to absolute beginners in his TV show (Mad Money) and books. Ultimately, misleading the general public who listens to his publications.

In March 2023, the birth of LJIM came in conjunction with the SJIM, both created by Matthew Tuttle, CEO of Tuttle Wealth Management.

Tuttle explained that he had created LJIM with the purpose to ignite a discussion on Cramer’s stock picks and possibly better inform investors to a more educated understanding in why Cramer made these decisions.

Story of LJIM unfolds

Described as a showman rather than a market guru by naysayers, Jim Cramer was often criticized for his poor stock picks that he publicize on his shows notably “Mad Money”.

General public consensus was that he was an armchair strategist in giving financial advice to beginners.

This led to the creation of SJIM with the aim to short Cramer’s stock picks. However, to avoid being seen as offensive, Tuttle created the LJIM in tandem in March 2023.

Tuttle seeks to hold Cramer accountable for the trade ideas he suggests by attracting his attention through LJIM ETF. He hoped that Cramer and CNBC would take on the stage to further justify his selections in response to the ETF.

Fast forward 6 months, the LJIM is set to be closed down on 11 September 2023.

This decision came after the ETF failed to garner enough interest from the general investors.

Furthermore, the ETF did not serve its purpose of creating a meaningful dialogue either. Cramer and CNBC ignored the ETF and refused to comment on their stock picks thus far.

Ironically, while the LJIM only managed to attract $1.3 million in assets, the SJIM ETF that bets against every action Cramer takes had attracted $3.4 million in investments.

Performance : LJIM vs SJIM

At this point, you might be wondering if the LJIM had underperformed SJIM in its short lifespan.

Well, quite the opposite:

Surprisingly, LJIM posted a much better return to date compared to SJIM providing investors with a positive 3.12% return on investment while SJIM resulted in a 4.90% loss for investors. Particularly, Nvidia and Meta (part of LJIM holdings) had spectacular runs this year, resulting in return on investment of about 100% and 63% returns since March 2, 2023 respectively.

However, its performance was due to the AI hype, which could be running out of fuel.

SJIM on the other hand holds multiple EV stocks that have recently entered a pretty volatile correction phase with a fall in prices of NIO and Tesla (which had a big impact on the fall in ETF price).

However, long term prospects seems rather optimistic with NIO scoring a deal with Oslo Taxi, seeing a penetration into the European EV market while Tesla revealed its first Cybertruck accompanied by continual price cuts on its existing products.

Furthermore, SJIM has companies like Walmart, Oracle Corp, etc., which are fundamentally strong.

Things definitely are not flowery as of now but on a long time horizon the SJIM seems to have a pretty high growth potential with these stocks under its harness.

Cramer’s Historical Performance

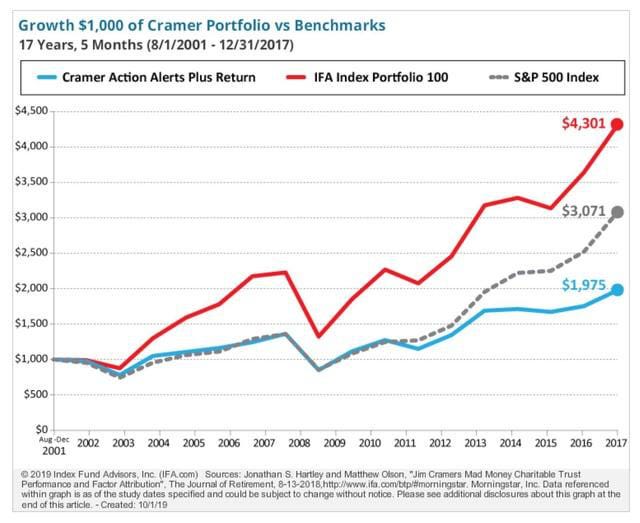

Since Cramer started the TV show “Mad Money” with CNBC, he has made numerous stock picks that have been put under scrutiny by many people. Many news websites have created in retrospect reviews of the stocks recommended by Cramer.

Namely, Hewlett Packard was recommended for investment in Cramer’s book “Getting Back to Even”, he then recommended immediate selling 3 years after the book was published and have netted a loss of 73.83% if it has been held throughout, as researched by CBS NEWS.

Furthermore, Yahoo finance has made multiple reviews on stocks that Cramer said was “About to POP”. Surely, there are certain stocks that outperformed the market but the majority of the stocks under review underperformed the market (relative to SPY) in a 6-month timeframe. In fact, they yielded negative returns resulting in heavy losses for “copy and paste” investors. These news researches solidifies the criticisms towards Cramer which sparked the interest in many people to create the SJIM.

Conclusion

I think it is so much easier for us to track Cramer’s stock picks with Tuttle’s help , and skip the difficulty of evaluating what stocks we want to buy ourselves.

BUT..

After all this do we still want to blindly follow anyone’s advice online even if they are the “experts” ?

Certainly not.

We need to understand why a stock is a good buy, what is so special about it.

The earnings?

The fundamentals?

Does the company have a comparative advantage?

If Jim Cramer could come out and answer these questions, providing deep insights. Maybe we can follow his ideas. Maybe we can be a copy-cat. And definitely, LJIM would not have been shut down.

Nevertheless, Cramer may be called a polarizing figure, a controversial one when picking stocks. Sometimes his points are not totally invalid either.

Recently, he offered his consensus on Nvidia stating it’s a company with very bullish long term outlooks. Along with it he also commented on Nvidia’s most recent pullback before Q2 2023 earnings stating “ Just because a stock has great products … does not mean it can grow to the sky.”

Unbelievably, he brought up a valuable lesson and for investors that stocks no matter how good they are don’t rally up linearly, pullbacks are part and parcel of price action to create resting periods to garner momentum for subsequent growths.

I hope to bring across that, not all available financial advice is valid but there certainly is merit in some of them.

I know what you’re thinking now..

So you’re saying we have to do our research every time we look to buy a stock?

I understand the pain and unfortunately yes!

We need the most accurate data.

From the case study about Cramer we will realize that following his advice is definitely a no-go but going against it by buying the SJIM made it worse by resulting in a 4.9% loss to date.

Do our due diligence and we wouldn’t be asking ourselves why we are losing money despite following “financial gurus” !